Continuous indirect tax compliance with agentic autonomy

MetaClerk is an AI native platform that works like a real compliance team, monitoring your global Sales Tax, VAT, and GST footprint and protecting you from indirect tax exposure with continuous oversight and intelligent action.

Request early access

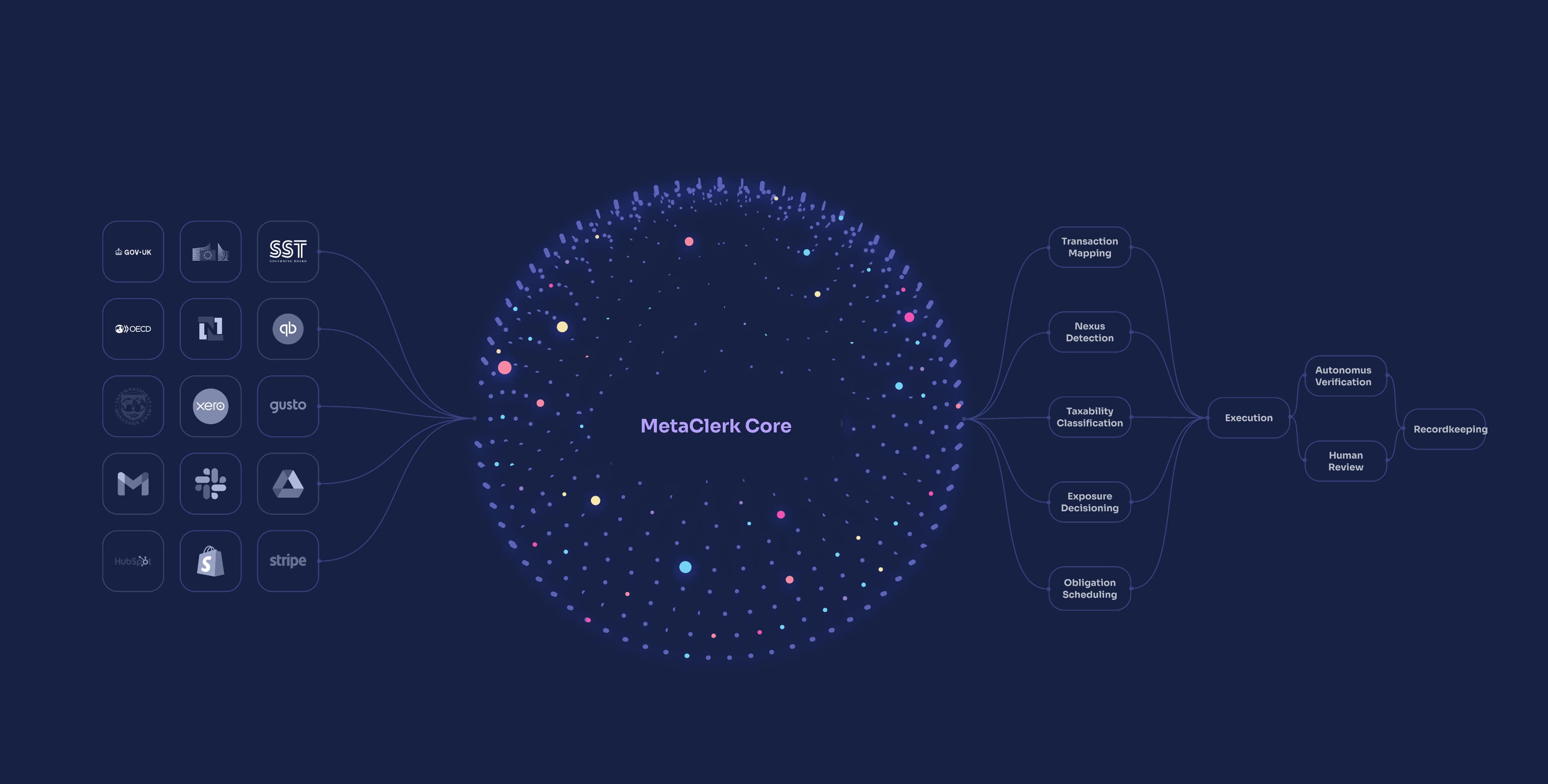

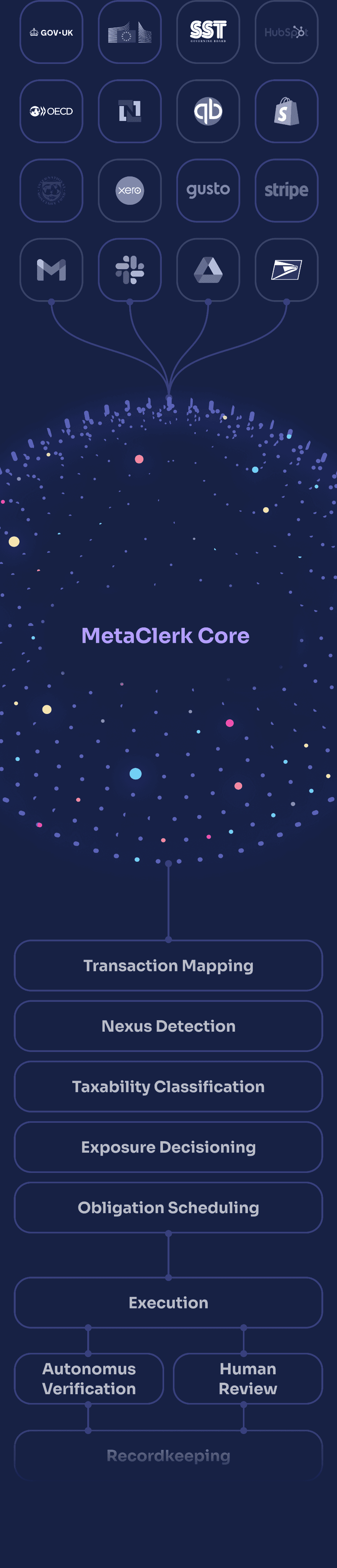

HOW METACLERK DELIVERS CONTINUOUS AGENTIC AUTONOMY

INGESTING JURISDICTIONAL AND BUSINESS DATA

ANALYZING EVERY SIGNAL AND TRIGGERING AUTONOMOUS ACTIONS

RUNNING A CONTINUOUS AGENTIC PIPELINE FOR COMPLIANCE

Always on, always ahead, never waiting for instructions

Every indirect tax trigger, handled by our autonomous agents.

MetaClerk agents gather everything they need from jurisdictions, systems, and your data, then handle compliance end to end with precise, verifiable execution.

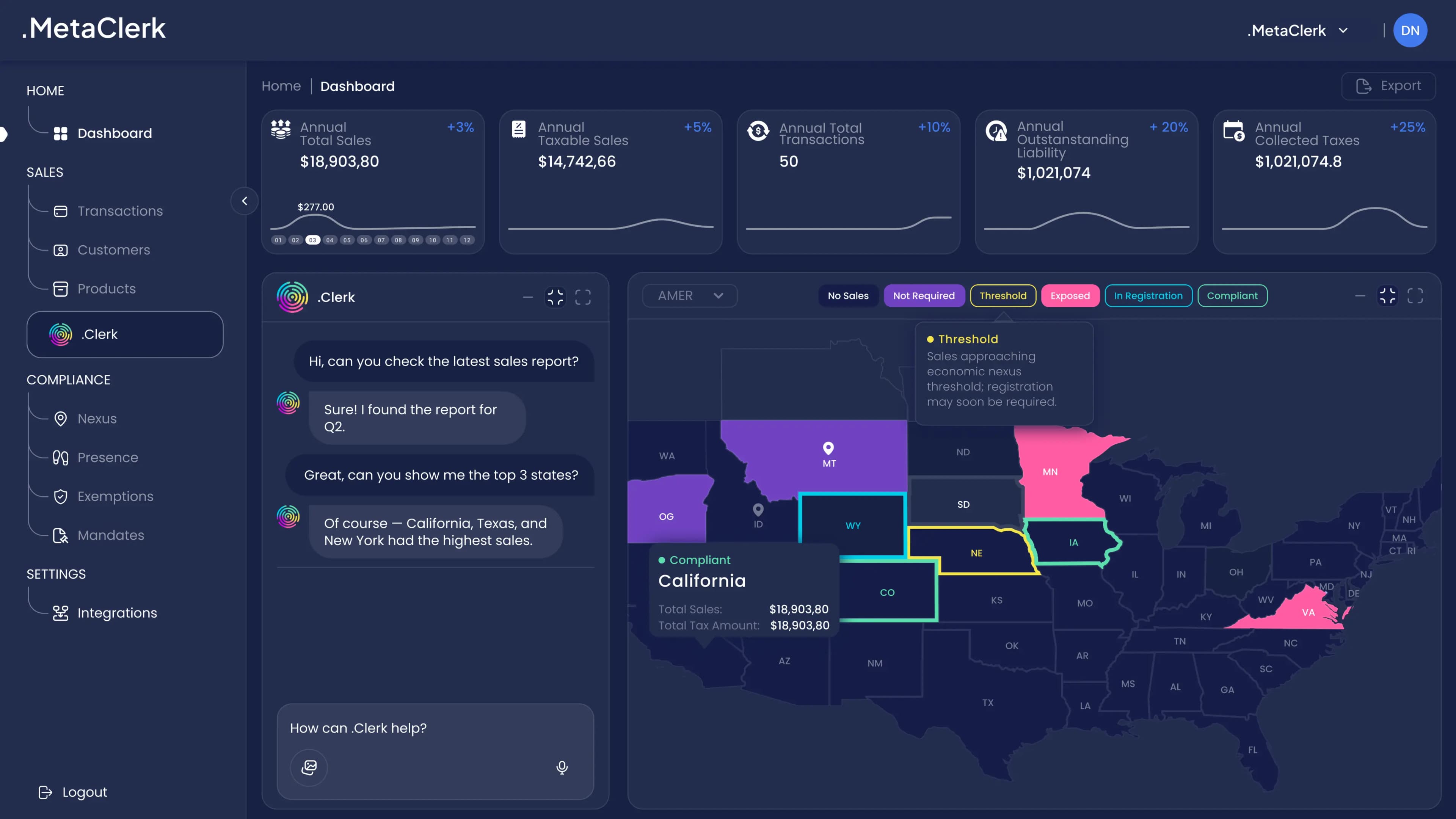

Talk to Clerk

CLERK

ORCHESTRATION AGENT

Coordinates and interacts with the user

SCOPOS

SENTINEL AGENT

Monitors signals and detects thresholds

SOPHIA

ANALYST AGENT

Analyzes rules, context, and compliance requirements

NOMOS

FIILING AGENT

Prepares and submits filings

TELOS

COMPLETION AGENT

Verifies and closes processes

AUTONOMOUS INTELLIGENCE

CONTINUOUS COMPLIANCE ENGINE

INSTANT ANSWERS, NO SETUP

GROW FASTER, WITH COMPLIANCE ON RAILS.

Get Started

Talk to Sales